Blog

Top Methods for Online Payment: The Benefits of Paying with Pay by Bank

March 14, 2023

Editorial Team

The benefits of paying online using pay by bank

With more and more payment options available to you it can be difficult to figure out which ones will work for you and your spending habits. One of the newer methods for online payment that’s building more and more adoption is pay by bank.

In this article, we’ll explore some of the main benefits of pay by bank you may experience as a consumer and where we see this payment method fitting into the payment space in the future.

What is pay by bank?

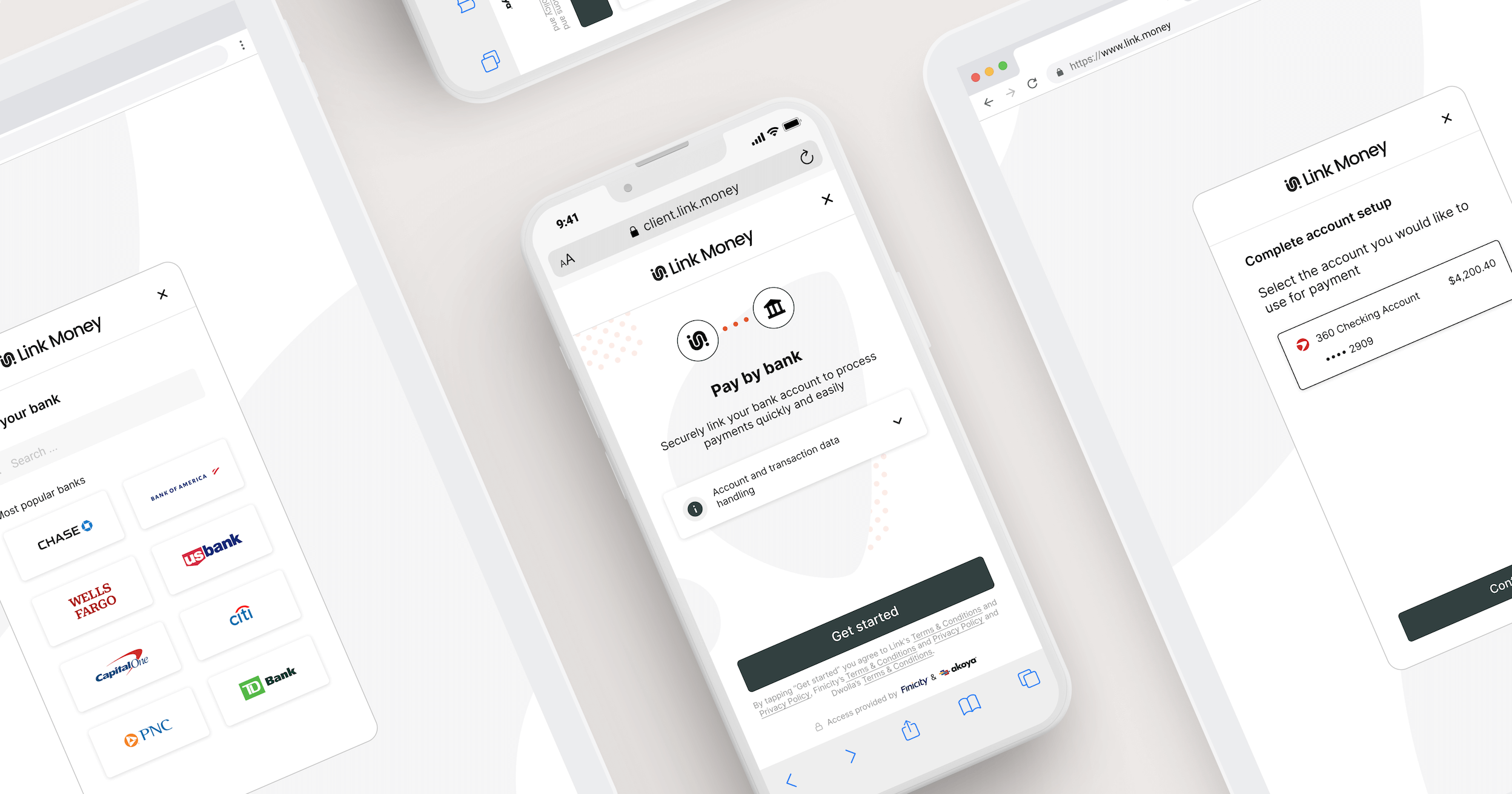

Pay by bank is a payment method that allows you to make online purchases directly from your bank accounts without needing to use a credit or debit card. This payment option became available due to a new technology known as open banking technology.

How does it work?

When making a payment online using pay by bank, you are redirected to your bank's mobile app or online banking page to complete the payment. Payments are made using your bank account details and require you to authenticate the payment with your bank.

Benefits of paying by bank

Here are six benefits we think pay by bank can offer you as a consumer when making payments online.

Faster online payments

Every time you make a payment online, you’re required to enter payment details at the checkout page. This means you have to spend extra time and effort to get your details ready before you pay.

Making sure you have your credit or debit card numbers, expiration dates, and CVV codes ready before checking out costs you time and effort. With pay by bank, you don't have to update your expiration date every time your card expires or add your CVV each time.

The money is transferred directly from your bank account into the company account without any extra steps of sharing information involved.

Increased security and privacy

The direct connection from your bank to the company is secure and encrypted. Plus, the company doesn’t store your login information anywhere which reduces the risk of data breaches. It’s more difficult for hackers to intercept and steal sensitive information through this process.

Skipping the extra steps of sharing sensitive financial information in the payment process with a third party or the company at the risk of your payment information being intercepted is much lower.

Once the payment has been made, you’ll see the transaction in your bank account in real-time, ensuring that there are no unauthorized charges or errors in transactions.

Credit or debit cards no longer required

Physical cards were created as an alternative to carrying cash or checks. As the financial services industry evolved, shopping moved online, making a payment required the card details to authorize a transaction. Each card also carries an expiry date which means you may need to check, update, or register a card before making a payment.

Pay by bank uses secure banking credentials directly from your account to authorize transactions. No extra details are needed from you at the checkout and your bank account details don’t expire or change without your knowledge.

Potentially reduces waste

According to the 2019 Experian Consumer Credit Review, the average American has four credit cards at any one time. Not only does this mean you have to stay on top of all your cards and what accounts they’re attached to, but the materials used to make these cards are mostly traditional PVC plastics which can be difficult to recycle.

With the card industry reportedly creating 6 billion cards annually, replacing one or a few of the cards you usually use to make online payments with a pay by bank service such as our service LinkPay could potentially reduce waste in the long term.

No need to remember multiple login details

Keeping your information secure online is a never-ending chore with login details for hundreds of different accounts that include passwords, extra authentication from a device, and much more.

When using pay by bank to make a payment, all you need is the same login credentials as your online banking account. You don’t need to create a separate account or remember new log in information.

Fewer fees compared to other payment methods

The average American household experiences $1,000 per year in credit card interest and fees alone. Plus, many credit cards or buy now pay later options charge fees and high-interest rates which can be difficult to stay on top of if you have multiple accounts.

Using pay by link to pay online in full means you pay quickly with your bank with zero extra costs and no surprise costs at a later date. You’ll see the payment in real-time in your bank balance so if you do need to double-check to make sure you have the funds you can quickly do something about it.

How pay by bank fits into the current payment landscape in the US

You may be wondering what makes this bank payment system different from digital payment options such as PayPal and where it currently sits within the financial services landscape.

There are several other payment methods available in the United States that offer similar functionality to pay by link. Below are a few examples:

Debit cards: Payments can be made using funds from direct debit accounts. There may be additional fees or overdraft fees, and debit cards can be more vulnerable to fraud.

Online bank transfers: Many banks offer their own online transfer services that allow customers to send money to other bank accounts using their online banking portal.

Digital wallets: PayPal, Apple Pay, and Google Wallet allow users to store payment information and make online purchases.

ACH payments: ACH (Automated Clearing House) payments allow for direct bank-to-bank transfers and are commonly used for things like payroll deposits, bill payments, and online transfers.

We can take this example of digital wallets a little further to explore its placement in the digital payment space.

Pay by bank vs digital wallets

Pay by bank and digital wallets are both digital payment methods, but there are a few important differences between them if we were to compare:

Integration with bank accounts: Pay by bank is directly integrated with bank accounts, whereas digital wallets require a bank account or credit card to the account separately.

Authentication: Pay by bank uses online banking credentials to authenticate a payment, whereas digital wallets require extra account details with a variety of ways to authenticate the payment.

Simple experience: Pay by bank is a more direct and streamlined payment method that uses your existing banking setup, whereas PayPal is a standalone platform that requires you to manage your account and link to your preferred funding sources.

Privacy: Pay by bank can be looked at as more private, as the consumer's personal banking information is not shared with a third party like PayPal.

Cost: Pay by bank is less expensive than PayPal for businesses. You don't see the costs directly, however, it means the company you purchased from may pay less in fees to accept the payment. This is great for independent businesses you want to help grow.

Limited availability and lack of awareness

Credit cards have been the default way to pay in the US for decades and although there have been slight adjustments to the way we pay using digital devices that are attached to these cards, there hasn’t been anything that could potentially replace them for digital payments online.

With only a few solid players with the technology to offer pay by bank integrations, in combination with legacy credit cards, this new payment method is just starting to take off in the US.

As an open banking innovator in the US, it’s an exciting time for us here at Link Money to share the benefits that you can pay with your bank directly.

We expect that in the next few years the use of this method for online payment will grow alongside more online stores embedding pay by bank as an option to keep up with the growing demand of over 289 million people expected to be shopping online by 2027.

Final thoughts

You may already see some places offering this payment option at the payment page in your favorite stores. We hope this article sheds a little more light on what the option is and the benefits of choosing pay by bank when making a payment.

If you have any questions at all about open banking, paying with your bank, and the financial industry feel free to reach out to us.