Blog

What is pay by bank? Four key things merchants need to know

April 6, 2023

Editorial Team

Pay by bank is a method of online payment that lets customers pay for goods and services using their bank account. However, there are some specifics and variations in what the term can mean in different contexts, as well as what the benefits are.

In this post, we will define this concept in some depth, discuss a few variations of how it may work (including clearing up some misconceptions), and briefly introduce Link Money - Pay by Bank as an example of a pay by bank solution.

1. Pay by bank is convenient for customers to pay with

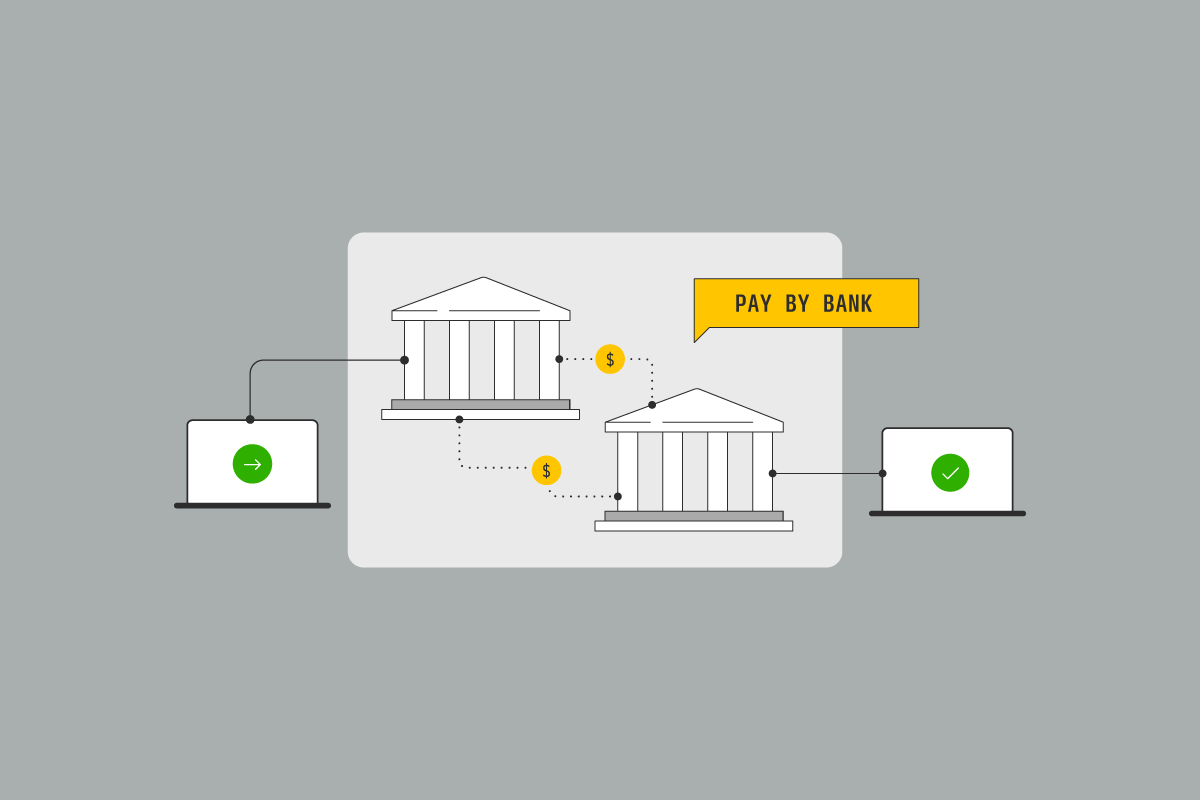

As mentioned, pay by bank is a method of online payment that lets customers pay for goods and services directly from their bank account. In fact, this customer payment flow is its defining characteristic. A typical payment flow looks something like this:

When a customer completes their shopping and starts to check out, they will see the pay by bank option.

Once this is selected, the customer will be prompted to choose their bank from a list, and be redirected to their bank app or website.

The customer authenticates the payment the same way they normally log in to their bank account — with a password, face ID, fingerprint scan, or however they have it secured.

As you can see, pay by bank is highly intuitive and easy for your customers. But there are several more advantages. First, customers don’t need to create an account, rather, they simply initiate the payment form their trusted bank environment. Second, a card is not required. This means less fiddling around with long card numbers, and no chance of dropping off because a card is expired, lost, or stolen. And third, unlike direct debits such as traditional ACH, there is no need for a customer to enter in account and routing numbers. These factors lead to a simple and easy checkout flow, which ultimately translates into a higher conversion for merchants.

2. Payment rails can vary

However, what happens once a payment is initiated can differ. Therefore, it is wise to bear in mind that if someone mentions pay by bank, it is referring to the experience of the payer, rather than what happens afterwards.

Once an online payment of any kind is initiated, regardless of whether it is a credit card, debit card, wallet or pay by bank, it needs to travel through a payment network or “rails”. The most common payment rails include Automated Clearing House (ACH), Mastercard, Visa, PayPal, and so on. What these all allow is for digital money transfers to be made between payers and payees.

When a customer initiates a payment with pay by bank there are a number of potential payment rails that could be used. For example, in the US, pay by bank providers tend to use ACH rails, but in the future may use FedNow. In Europe, where pay by bank is already popular, SEPA is common. The key thing here to keep in mind is that while pay by bank is always initiated in the payer’s bank environment, the rails used to transfer the funds can differ depending on the payment technology provider and the market.

3. There are some common points of confusion about where pay by bank sits in the payments ecosystem

It is important to note there can be some confusion and gray areas in how the term “pay by bank” is used, so it’s a good idea to clarify the key points of confusion here.

1. Payment method vs. product name

Pay by bank is a generic term for the payment method, but can also be a product name from a specific company. In fact, some fintechs and several established financial institutions offer pay by bank products, including Link Money.

2. Pay by bank vs. A2A payments

The short clarification here is that pay by bank IS generally an A2A payment, but A2A payments are broader than only pay by bank. This is because while A2A payments allow consumers to directly transfer funds from their bank account to the merchant's account without a card, A2A payments can also include things such as wages, refunds, and other types of transactions, as well as pay by bank. Read more: What are account-to-account (A2A) payments?

3. Pay by bank and related payment methods

ACH direct debit or its direct debit equivalents are not “pay by bank”, since they require the consumer to input account details and any authentication will have to happen separately (such as by cumbersome microdeposits). While some wallets can be funded directly from a bank account, they are not considered to be pay by bank, since the consumer selects the wallet at checkout, and the merchant still needs to pay the wallet’s expensive transaction fees.

4. Pay by bank offers a range of benefits for merchants

Let’s take a look at some of the biggest challenges facing merchants online today.

First, accepting card and transaction payments are unnecessarily expensive, at 3-4% of each transaction. Second, there is the ever-present problem of cart abandonment. The average cart abandonment rate is persistently high at 70%, and 17% of US online shoppers abandoning an order solely due to a “too long/complicated checkout process”. And third, fraud is an expensive problem, costing merchants in multiple ways — through the loss of revenue or physical goods is the obvious one, but also through needing to implement fraud management solutions to reduce risk as well.

Pay by bank can reduce all these risks. Since they do not run on cards’ rails, transaction fees tend to be lower. The checkout experience is also smoother, as the customer pays from their trusted bank environment, driving up conversion. And because bank authentication tends to be strong, the risk of fraud is also lower. For these reasons, pay by bank should be considered a potentially valuable payment method to add to the checkout for many merchants online.

Introducing Link Money - Pay by bank

As the name suggests, Link Money - Pay by Bank is the first US-focused pay by bank product. For merchants, using Link Money costs around 70% less on average than a credit card transaction, and comes with extra features such as smart retries to ensure payments have the maximum chance of success, and verification to ensure that your customers are connecting real bank accounts. Link Money - Pay by Bank is built on open banking technology.

To find out more about how pay by bank could help your business, get in touch.